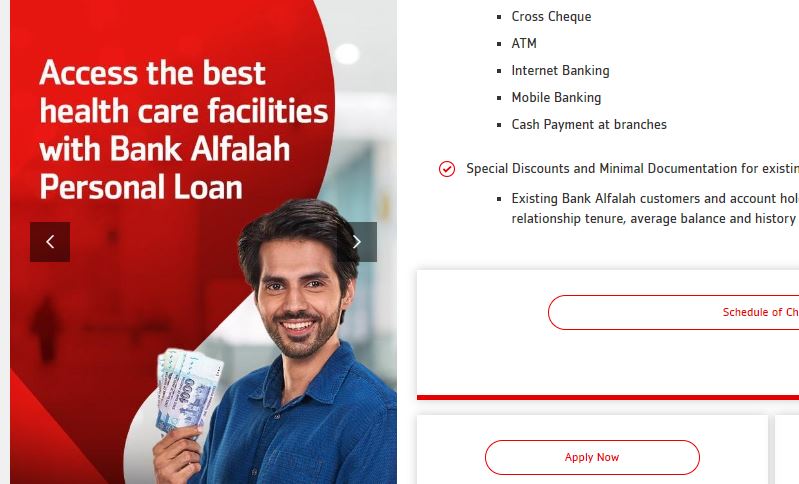

How to Get Loan from Bank Alfalah 2024

How to Apply Loan from Bank Alfalah

Bank Alfalah provides several loans for diverse requirements. The loan process is discussed below, in its general steps.

Choose the Right Loan

Personal Loan

This can be used for multiple needs such as home improvement, medical expenses or consolidating debts.

Auto Loan

This is for buying either a brand new or second-hand vehicle.

Home Loan

This can be used to buy a new house or to refinance a current home mortgage.

Designed for meeting business expansion and entrepreneurial needs.

Required Documents to Apply Loan

* **Identity Proof:** CNIC (National Identity Card)

* **Income Proof:** Salary slips, income tax returns, business documents

* **Address Proof:** Utility bills, tenancy agreement

* **Other Documents (as applicable):** Credit score report, property documents

Visit a Bank Alfalah Branch

Find the branch of the Bank that is located closest to your home and book a date and time with a loans officer. Talk about how much loan you would require and what are your income levels.

Submit Loan Application

Complete the loan application procedure by filling in the application form and giving the relevant documents.

The officer dealing with loans will consider your submission and appraise your capacity to pay back the loan on the agreed terms.

Loan Approval and Disbursement

Over here, the bank will examine your application and announce the total amount you may receive, the interest rate charged, as well as the terms of repayment when one is successful.

After matching all other requirements and successfully applying for the loan, the amount will transfer to your account as regular crops grown.

Additional Tips

Check Eligibility:

Before applying for a loan, it is important to check whether you are eligible or not based on the criteria that were provided by the bank pertaining to income, credit history and so on.

Compare Rates:

Minimum and maximum rates on interest should be sought and lending institutions should be compared on this.

Read Terms and Conditions:

Interest may be charged, limitations on some fees and some other possible situations should be elaborately explained in the loan contract provided for the borrower’s signature.

Consider Online Applications:

Some loan applications for certain products may be applied for online through Bank Alfalah, this could prove much more efficient and speedy.

For more specific information and for the purpose of estimating what some potential loan amounts for your needs, contact Bank Alfalah directly or visit depending on the geography of the customer www.bafalah.com website:

visit Bank Alfalah Website for more details

Visit: Loan must vary from bank to bank accordingly, hence it will be very prudent to seek intelligent information from Bank Alfalah.

anccod