Easypaisa Loan: Everything You Need to Know

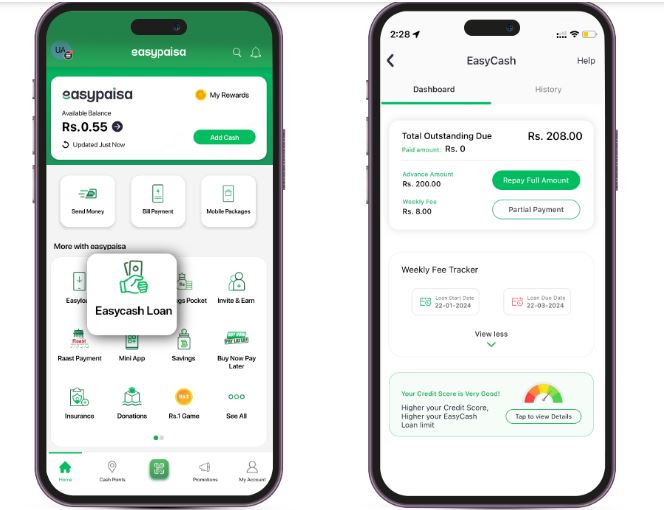

Easypaisa, Pakistan’s most popular digital financial platform, has launched a banking loan service called Easycash, which allows users to get easy loans for the purpose of meeting immediate cash flow or financial needs. Managed by Telenor Microfinance Bank, this service is meant to enhance financial inclusion with instant loans without hassle of paperwork.

also peoples asking that Easypaisa se loan kese lein?

How to apply for Easypaisa Loan?

Eligibility Requirements:

These loans are only opted by the registered users that meet the credit score criteria as preferred by Easypaisa’s internal credit scoring system. This score is determined by the user’s transaction history and account activity.

Application Process:

Go to the Easypaisa app and log in to your account.

Go to EasyCash tab.

Specify the loan amount you wish (which can reach PKR 15,000, on eligibility).

When the amount is requested and confirmed, it is deposited immediately into the user’s Easypaisa account.

Repayment Options:

Users can also view their outstanding balance service fees and due dates from the EasyCash menu. Users can pay back the loan in part or whole using the application as per the desired schedule making Easypaisa a great option for all repayment options.

Features and Benefits

No Documentation Required:

Loans are approved instantly and no physical documentation is required.

Loan Amount:

The users can avail of a loan from PKR 1,000 to PKR 15,000.

Transparent Charges:

No hidden charges, all fees visible in the app before loan approval.

Flexible loan repayments:

The loan can be repaid in installments or as a lump sum, giving it the potential to ease over-the-top finances.

User Centric Design:

The service is designed for the underbanked users in the context of Pakistan, part of financial inclusion.

Why Choose Easypaisa Loans?

EasyCash which is Easypaisa special remittance offer excels in accessibility reach and convenience. Unlike traditional loans that involve lengthy paperwork and processes.

EasyCash provides a quick and easy online platform. It’s especially advantageous for those who require immediate funds for emergencies or short-term expenses.

With over 40 million registered users on the platform, EasyPaisa through its microloan arm EasyCash is filling in the gaps for financial inclusion for many who might lack traditional banking services.

This initiative is in line with Easypaisa’s vision to build a financially inclusive digital economy of Pakistan.

Important Considerations

Credit score:

Responsibly paying off loans can boost your credit score, whereas making late payments could hurt it.

Interest Rates And Fees:

Check the relevant service fees and interest rates before you confirm the loan.

Repayment Obligations:

Have a repayment plan in place to avoid late fees or the risk of damaging your credit score.

Easypaisa EasyCash is a game changer for the short term borrowing industry in Pakistan. Detail and applying feature is available with official Easypaisa app or through calling out Easypaisa customer service.