Looking for a bank loan in Pakistan in 2025? You’re in the right spot. With so many banks offering different loan options, it can get confusing. Whether you’re eyeing a personal loan, a business loan, or something else, understanding your options is key. Let’s explore some of the top banks and what they offer to help you make the right choice.

Key Takeaways

Top Banks Offering Loans in Pakistan 2025

In 2025, several banks in Pakistan stand out for their loan offerings, catering to diverse financial needs. These banks provide a range of loan products, from personal loans to business financing, each with unique features and benefits.

Habib Bank Limited Loan Options

Habib Bank Limited (HBL) is one of the largest banks in Pakistan, renowned for its extensive loan options. From personal loans to home financing, HBL offers flexible terms and competitive interest rates. Their personal loans are particularly popular for their quick approval process and minimal documentation requirements. HBL’s customer-centric approach ensures that borrowers can find a loan product that suits their financial situation.

MCB Bank Loan Features

MCB Bank is another key player in the Pakistani banking sector, offering a variety of loan products. Their personal loans come with attractive interest rates and flexible repayment plans, making them accessible to a wide range of customers. MCB’s business loans are tailored to support small and medium enterprises, providing them with the necessary capital to grow and expand.

United Bank Limited Loan Services

United Bank Limited (UBL) offers a comprehensive suite of loan services, catering to both individuals and businesses. Their personal loans are designed for convenience, with easy online application processes and quick disbursements. UBL also provides specialized loan products for education and housing, ensuring that customers have access to funds for their specific needs. The bank’s commitment to customer service makes it a preferred choice for many borrowers.

In 2025, choosing the right bank for a loan in Pakistan involves considering not just the interest rates, but also the flexibility and support provided by the bank. Each of these top banks offers unique advantages that can meet the varying needs of borrowers.

Understanding Loan Eligibility Criteria

When it comes to getting a loan in Pakistan, understanding the eligibility criteria is crucial. Banks have their own set of rules and requirements, and it’s important to know what they are before you apply.

Age and Income Requirements

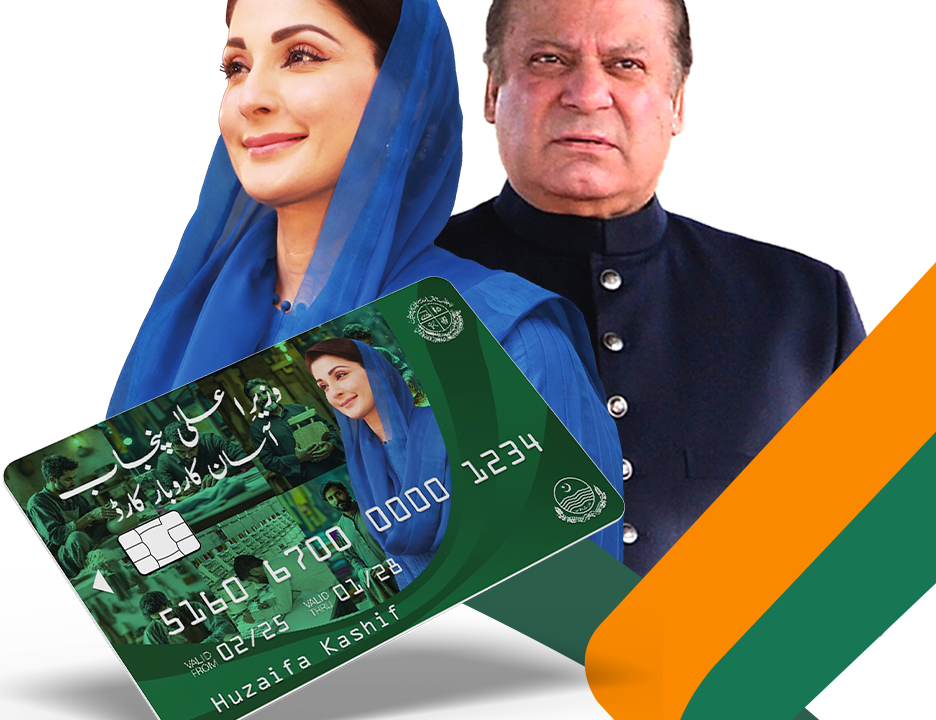

Most banks in Pakistan have specific age and income requirements for loan applicants. Generally, you need to be at least 21 years old to apply for a loan, although some banks may require you to be older, especially if you’re self-employed. For example, the Karobar Card loan requires applicants to be between 18 and 55 years old.

Income requirements can vary significantly, but a common threshold is a minimum monthly income of PKR 35,000, especially for salaried individuals. This ensures that you have a stable income to cover the monthly installments.

Necessary Documentation

Documentation is a key part of the loan application process. Typically, you’ll need to provide:

Some banks offer the convenience of applying through mobile apps, which might reduce the need for physical documents.

Credit Score Considerations

Your credit score plays a significant role in determining your loan eligibility. A higher credit score can increase your chances of getting approved and might even help you secure a better interest rate. Banks look at your credit history to assess your financial responsibility and ability to repay the loan.

Knowing the eligibility criteria beforehand can save you time and increase your chances of loan approval.

Comparing Interest Rates Among Pakistani Banks

Fixed vs Variable Rates

When you’re looking at loans, one of the first things you’ll notice is the choice between fixed and variable interest rates. A fixed rate stays the same throughout the loan term, giving you predictable monthly payments. On the other hand, a variable rate might start lower but can change over time, depending on market conditions. Choosing between these two depends on your risk tolerance and financial stability. If you prefer certainty in your payments, a fixed rate might be your best bet. However, if you’re okay with some fluctuation and potentially lower costs, a variable rate could work in your favor.

Impact of Loan Tenure on Rates

The length of your loan, or the loan tenure, can significantly affect the interest rate you pay. Generally, shorter loans come with lower interest rates, but they also mean higher monthly payments. Conversely, longer loans might offer smaller monthly payments but at a higher interest rate. It’s crucial to balance what you can afford monthly with the total interest cost over the life of the loan.

Promotional Offers and Discounts

Banks often roll out promotional offers and discounts to attract borrowers. These can include reduced interest rates for a limited time or waivers on processing fees. Keep an eye out for these deals, especially if you’re planning to take a loan soon. They can save you a considerable amount of money in the long run. However, always read the fine print to ensure there are no hidden charges or conditions that could catch you off guard later.

Application Process for Bank Loans in Pakistan

Navigating the bank loan application process in Pakistan can feel a bit overwhelming, but breaking it down step-by-step makes it manageable. Here’s how you can go about it:

Online Application Steps

In-Branch Application Procedures

Common Application Mistakes to Avoid

Applying for a bank loan in Pakistan is a straightforward process if you’re prepared and informed. Whether you choose to apply online or in person, understanding each step will help you navigate the process smoothly. Always remember to keep track of your application status and be patient as banks handle multiple applications daily.

Repayment Options and Flexibility

Monthly Installment Plans

When it comes to repaying your loan, having a clear and manageable plan is key. Most banks in Pakistan offer flexible monthly installment plans, allowing you to choose a schedule that fits your financial situation. Whether you prefer a short-term commitment or a longer duration, the choice is often yours. For instance, Allied Bank provides personal loans with easy repayment options through equal monthly installments, letting customers select their preferred installment duration.

Early Repayment Benefits

Paying off your loan ahead of schedule can be a smart move. Many banks offer the option to settle your loan early, which can save you money on interest. However, it’s important to check if there are any prepayment penalties involved. Some institutions may charge a fee for early repayment, so it’s wise to review the terms and conditions carefully before making any decisions.

Penalties for Late Payments

Missing a payment can have consequences. Banks typically impose penalties for late payments, which can add to your financial burden. It’s crucial to understand the penalty structure and make timely payments to avoid these extra costs. Setting up automatic payments or reminders can help you stay on track and maintain a good credit standing.

Tip: Always read the fine print of your loan agreement. Understanding the repayment terms, including any penalties or benefits, can help you manage your loan more effectively and avoid unexpected surprises.

Special Loan Programs for Different Needs

Loans for Small Businesses

Small businesses are the backbone of any economy, and in Pakistan, banks offer various loan programs to support them. These loans often come with flexible terms and competitive interest rates to help businesses grow and thrive. Whether you’re looking to expand your operations or need working capital, banks like Akhuwat provide up to Rs. 50 million in financing options. Here’s a quick look at some features:

Personal Loans for Individuals

When life throws unexpected expenses your way, personal loans can be a lifesaver. Banks in Pakistan offer personal loans with no collateral, making it easy for individuals to manage their finances. For instance, HBL provides loans up to PKR 3,000,000 with a flexible repayment period of 12 to 48 months. Key benefits include:

Educational Loans for Students

Education is a significant investment, and banks in Pakistan recognize this by offering educational loans tailored to students’ needs. These loans cover tuition fees, accommodation, and other related expenses. The repayment terms are generally flexible, allowing students to focus on their studies. Some banks even offer grace periods until after graduation, easing the financial burden on students and their families.

Tip: Always compare loan options and terms before committing, as this can significantly impact your financial planning in the long run.

Customer Support and Services

24/7 Helpline Availability

When it comes to banking, having support whenever you need it can make a world of difference. Many banks in Pakistan offer a 24/7 helpline, ensuring that help is just a phone call away, no matter the time of day. This round-the-clock service provides peace of mind, knowing that assistance is available for any banking issue. Whether it’s a question about your account or a more complex issue, the helpline is your go-to resource.

Branch Locator Services

Finding the nearest bank branch shouldn’t be a hassle. Banks in Pakistan provide branch locator services on their websites and mobile apps. These tools are user-friendly, allowing you to quickly find the closest branch based on your location. Some banks even offer additional details like branch hours and available services, so you can plan your visit accordingly.

Feedback and Complaint Resolution

Customer feedback is vital for banks to improve their services. Most banks have established systems for handling complaints and suggestions. You can usually submit your feedback online or in person at a branch. Once a complaint is filed, banks strive to address the issue promptly and effectively. This commitment to resolving issues helps build trust and loyalty among customers.

Banking services are only as good as the support behind them. With comprehensive support systems in place, Pakistani banks aim to provide a seamless experience for their customers.

Conclusion

So, there you have it. If you’re in Pakistan and looking for a loan, there’s a bunch of banks ready to help you out. From big names like Habib Bank and Bank Alfalah to microfinance options like Khushhali Bank, there’s something for everyone. Just remember, each bank has its own rules and rates, so it’s worth shopping around to find what suits you best. Whether you need a little cash to tide you over or a bigger amount for something major, these banks have got you covered. Just make sure you meet their requirements and have your documents ready, and you’ll be on your way to getting the financial support you need.

Frequently Asked Questions

What is the least and most I can borrow?

You can borrow as little as PKR 30,000 and as much as PKR 4 million, depending on your qualifications and ability to pay back.

How long can I take to repay a loan?

You can choose to repay your loan over a period of 12 to 60 months.

How soon will I know if my loan is approved?

Once all your papers are in, it usually takes about 10 working days to approve your loan.

Can I repay my loan early?

Yes, you can pay off your loan early, which might save you money on interest.

Do I need to give something as security for a loan?

Most personal loans don’t need any security or collateral.

What if I miss a loan payment?

If you miss a payment, you might have to pay a late fee, so it’s best to pay on time.