This scheme is a fresh way to support businesses in Punjab. It lets businesses get financial help and resources to succeed. The Punjab government’s effort shows its dedication to helping businesses grow and develop.

Introduction to the Karobar Card Scheme

The scheme is a big part of the Punjab government’s plan to help small and large businesses. Its success depends on businesses joining in. The Karobar Card Scheme is a great chance for Punjab businesses to get the help they need to grow.

By offering financial benefits and support, the scheme aims to positively change the business scene in Punjab.

Key Takeaways

- The punjab cm’s karobar card scheme is a groundbreaking initiative to support small and large businesses in punjab.

- The scheme provides financial benefits and support features to entrepreneurs and business owners in punjab.

- The karobar card scheme is designed to support businesses in punjab, providing them with the necessary resources to grow and thrive.

- The punjab government’s initiative is a testament to its commitment to promoting business growth and development in the region.

- The scheme is an exciting opportunity for businesses in punjab to access the resources they need to grow and succeed.

- The karobar card scheme aims to make a positive impact on the business landscape of punjab.

Understanding the Karobar Card Scheme Initiative

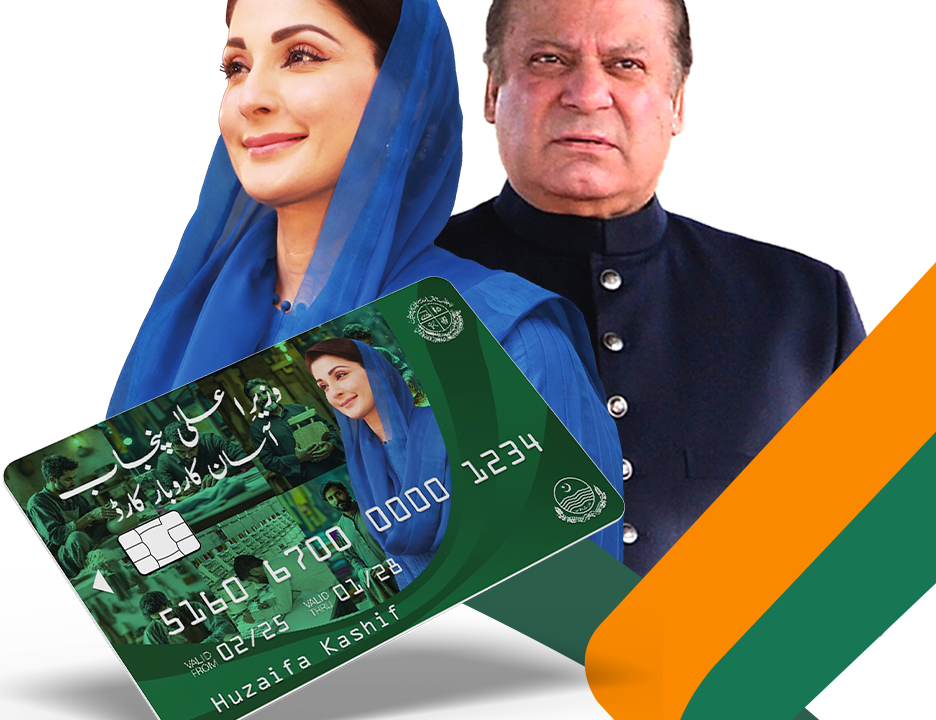

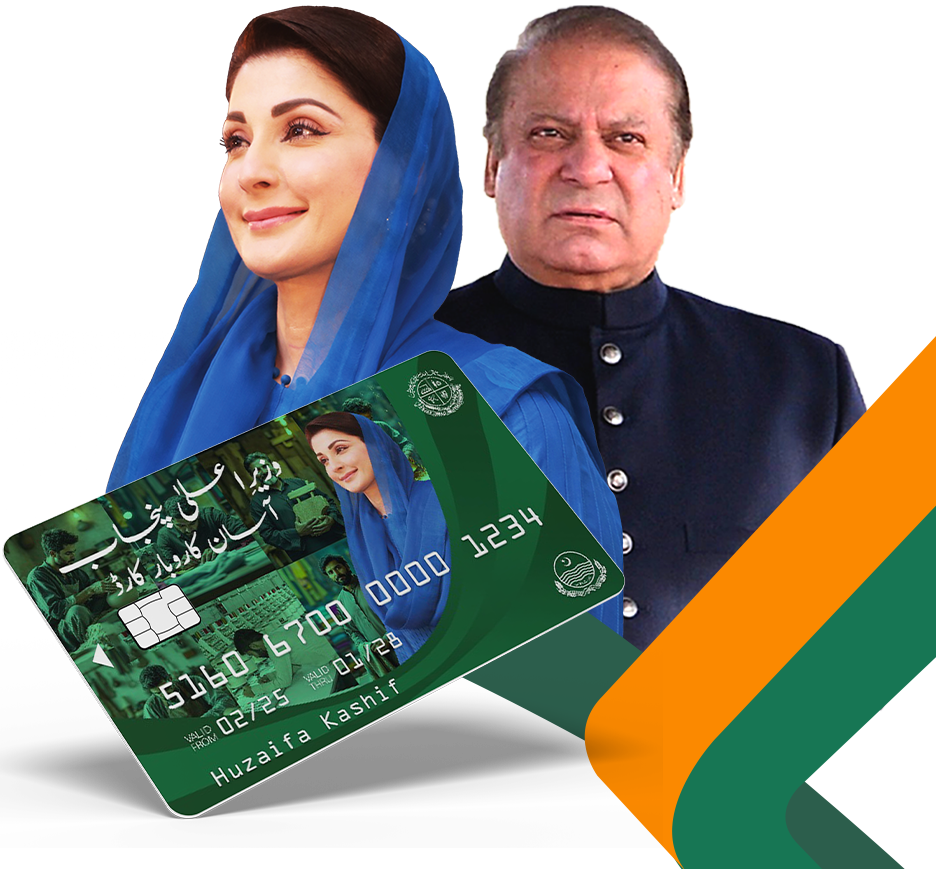

The Karobar Card Scheme is a big program to help businesses grow in Punjab. maryam nawaz is key in making it happen. It gives money and support to all kinds of businesses, helping the economy and creating jobs.

This scheme is all about helping small businesses succeed. It gives them the tools they need to grow. This helps the economy, creates jobs, and makes life better in Punjab.

The scheme’s main goals are to make it easy to get money, improve business places, and make the business environment better. The Punjab government is very important in making this happen. They give the money and help needed for the scheme to work.

Definition and Core Purpose

The Karobar Card Scheme is a program that helps all kinds of businesses in Punjab. It gives them money and support to grow and create jobs.

Key Objectives of the Scheme

The scheme’s main goals are:

- Make it easy for businesses to get money

- Improve business places and facilities

- Make the business environment in Punjab better

Role of Punjab Government

The Punjab government is very important in making the Karobar Card Scheme work. They give the money and support needed for businesses to grow. This helps everyone involved, with maryam nawaz’s vision leading the way.

Chief Minister Maryam Nawaz’s Vision for Business Growth

Chief Minister Maryam Nawaz has a clear vision for business growth in Punjab. This vision is shown in the Karobar Card Scheme. She aims to make a business-friendly environment that boosts entrepreneurship and innovation.

The scheme aims to boost economic growth, create jobs, and raise living standards in Punjab. With her leadership, the Punjab government is ready to support entrepreneurs and business owners. They want to create a place where businesses can grow and develop.

Some key features of the Karobar Card Scheme include:

- Access to financing and credit facilities

- Business training and mentorship programs

- Marketing and advertising support

- Networking opportunities with other businesses and investors

These features help businesses at every stage, from starting up to growing. The Punjab government wants to boost economic growth and build a strong business community.

The Karobar Card Scheme is a big part of Chief Minister Maryam Nawaz’s plan for business growth in Punjab. It supports entrepreneurship and economic growth. This scheme could have a big impact on the province’s economy and improve people’s lives.

| Feature | Benefit |

|---|---|

| Access to financing | Enables businesses to invest in growth and development |

| Business training | Equips entrepreneurs with the skills they need to succeed |

| Marketing support | Helps businesses reach new customers and increase sales |

Eligibility Criteria for the Karobar Card

To get the Karobar Card, businesses in Pakistan need to meet certain requirements. The scheme helps both small and large businesses grow. They must have a minimum turnover and be registered with the right authorities.

The rules are set to help only real businesses get the scheme’s benefits. Small businesses need a PKR 1 million turnover, while large ones need PKR 10 million. They also need to show they’ve been in business for a while and are registered.

Requirements for Small Businesses

- Minimum turnover of PKR 1 million

- Registered with the relevant authorities

- Must have a valid business license

Large Business Prerequisites

- Minimum turnover of PKR 10 million

- Proven track record of business operations

- Must have a valid business license

By meeting these criteria, businesses in Pakistan can benefit from the Karobar Card Scheme. It’s made to help businesses grow and succeed.

Documentation Needed

Businesses need to provide documents to apply, like registration papers, tax returns, and financial statements. These documents help check if a business is eligible for the scheme’s benefits.

Financial Benefits and Support Features

The Karobar Card Scheme offers many financial benefits and support features to eligible businesses. These include access to low-interest loans and subsidies on equipment and raw materials. These are designed to help small businesses overcome challenges and grow.

Through government initiatives like the Karobar Card Scheme, businesses get the support they need to succeed.

Some key benefits and support features of the scheme are:

- Low-interest loans to help businesses invest in their operations

- Subsidies on equipment and raw materials to help reduce costs

- Tax exemptions to help businesses retain more of their profits

- Training and mentorship programs to help businesses develop their skills and knowledge

- Access to markets and networks to help businesses expand their customer base

These benefits are for both small businesses and large ones. They are part of the government initiatives to support business growth. The Karobar Card Scheme helps create a better business environment, promoting economic growth and development.

Application Process and Registration Steps

The Karobar Card Scheme‘s application process is easy and open to all businesses. This includes big companies and startups. To start, businesses can go to the Punjab government website and use the online form.

This online method lets businesses upload their documents and check their application’s status. It’s fast and easy. For those who prefer to apply in person or don’t have internet, there are offline options too.

Key Registration Steps

- Submit application and required documents

- Track application status online

- Receive notification of application outcome

Applications are usually processed in 2-3 weeks. After that, businesses will know if they got the Karobar Card. The scheme aims to help big businesses and startups in Punjab grow and develop.

Impact on Small-Scale Enterprises

The Karobar Card Scheme has boosted economic growth in Punjab, especially for small businesses. It offers low-interest loans and financial perks. This helps these businesses grow and create jobs.

Small businesses now have better financial health. They can invest in their growth. This has led to more sales and revenue, helping the local economy.

Many small businesses have seen big improvements. They can produce more, make better products, and reach more customers. These successes show the Karobar Card Scheme’s power to grow the economy and businesses in Punjab.

Success Stories

- Increased sales and revenue among small businesses

- Expansion of operations and creation of new jobs

- Improved financial stability and access to low-interest loans

Financial Improvements

The Karobar Card Scheme has brought big financial gains. Small businesses now have better cash flow and less debt. This lets them invest in their future, driving business development and economic growth.

Benefits for Large Business Operations

In pakistan, the Karobar Card Scheme brings many benefits to big businesses. Thanks to government help, these benefits include low-interest loans and subsidies. They also get tax breaks and support for growing their business.

Some of the main advantages for large businesses are:

- Access to low-interest loans to support business expansion

- Subsidies on equipment and raw materials to reduce operational costs

- Tax exemptions to increase profit margins

- Training and mentorship programs to enhance business skills

- Access to markets and networks to expand customer base

The Karobar Card Scheme supports big businesses in pakistan. This helps the economy grow and creates jobs.

| Benefit | Description |

|---|---|

| Low-interest loans | Support business expansion and development |

| Subsidies on equipment and raw materials | Reduce operational costs and increase profit margins |

| Tax exemptions | Increase profit margins and support business growth |

Implementation Timeline and Phases

The Karobar Card Scheme is being rolled out in phases. It aims to support small businesses and boost entrepreneurship in Punjab. The first phase is already in action.

The plan is to make sure the scheme works well. This way, businesses can get the help they need. Future plans include growing the scheme in Punjab and offering more funding.

Some key features of the plan include:

- Phase 1: Focus on supporting small businesses and entrepreneurship

- Phase 2: Expansion to other parts of Punjab

- Phase 3: Increase in funding available to businesses

The Karobar Card Scheme is a big step for small businesses and entrepreneurship in Punjab. Its success will help the local economy a lot.

| Phase | Focus | Timeline |

|---|---|---|

| Phase 1 | Small businesses and entrepreneurship | Already underway |

| Phase 2 | Expansion to other parts of Punjab | Planned for next year |

| Phase 3 | Increase in funding available to businesses | Planned for the following year |

Supporting Infrastructure and Resources

The Karobar Card Scheme is made for large businesses to boost economic growth in Punjab. It offers many tools and resources. These include training, mentorship, market access, and financial help.

Businesses get access to:

- Equipment and raw materials

- Subsidies and tax breaks for eligible businesses

- Training and mentorship to tackle challenges

This support helps large businesses grow and succeed. It leads to more jobs and investment in Punjab. This is good for the economy and development.

The scheme’s resources are wide-ranging and for all businesses in Punjab. They help businesses face challenges, become more competitive, and grow the economy.

Monitoring and Evaluation System

The Karobar Card Scheme has a strong monitoring and evaluation system. It tracks how well businesses do and if the scheme works. This is key for business development and making sure the scheme hits its goals. The government’s efforts have been crucial to its success.

Performance Metrics

The scheme looks at how many businesses it helps, how much money it gives out, and its impact on the economy. These numbers show how well the scheme does and where it can get better. Some important metrics are:

- Number of businesses supported

- Amount of funding disbursed

- Impact on economic growth and development

Quality Assurance Measures

The scheme has regular checks and a way to handle complaints. These steps make sure the scheme works well and businesses get the help they need. The government’s support has helped build a strong quality framework.

The monitoring and evaluation system makes sure the scheme is working right. It tracks key numbers and has quality checks. This way, the scheme keeps helping business development and boosting the economy, thanks to government initiatives.

| Performance Metric | Target | Actual |

|---|---|---|

| Number of businesses supported | 1000 | 1200 |

| Amount of funding disbursed | $1 million | $1.2 million |

| Impact on economic growth and development | 5% | 7% |

Economic Impact on Punjab’s Business Landscape

The Karobar Card Scheme has made a big difference in pakistan, especially for small businesses. It has opened doors to finance and better infrastructure. This has led to more jobs and investment opportunities.

Some of the key benefits of the scheme include:

- Improved access to finance for small businesses

- Enhanced infrastructure to support business growth

- Increased competitiveness of businesses in pakistan

This scheme has also boosted economic growth and development. It focuses on helping small businesses to strengthen the economy. As it grows, it will continue to shape the business scene in pakistan.

The Karobar Card Scheme is a great example of how government initiatives can support business growth and development, and we expect to see a significant impact on the economy in pakistan.

Conclusion: Transforming Punjab’s Business Ecosystem Through the Karobar Card Initiative

The Karobar Card Scheme is changing Punjab’s business scene. It offers key support and resources to all kinds of businesses. This makes it a key player in entrepreneurship and growth.

It gives financial help and infrastructure support. This lets businesses grow and succeed. The stories of small businesses and big companies show its success. The Karobar Card is expected to keep boosting economic growth and creating jobs.

The Punjab government’s support for businesses is impressive. The Karobar Card Scheme is a great example of how government help can make a big difference. It will keep playing a big role in making Punjab’s business scene better and more prosperous.

FAQ

What is the Karobar Card Scheme?

The Karobar Card Scheme is a new program by the Punjab government. It aims to help small and big businesses grow. It offers financial help and support to entrepreneurs, aiming to boost the economy.

What are the key objectives of the Karobar Card Scheme?

The scheme’s main goals are to make finance easier to get and improve business setups. It wants to make Punjab a better place for businesses to grow. It encourages new ideas and helps both small and big businesses succeed.

What are the eligibility criteria for the Karobar Card Scheme?

To get the Karobar Card, businesses need to meet certain rules. Small ones must earn at least PKR 1 million and be registered. Big ones need to earn PKR 10 million and show they’ve been in business for a while. You’ll need to provide documents like business registration and financial statements.

What are the financial benefits and support features of the Karobar Card Scheme?

The scheme offers many benefits. Businesses get low-interest loans and help with equipment and materials. They also get tax breaks and support for growing their business. This includes training and help finding new customers.

How can businesses apply for the Karobar Card Scheme?

Applying is simple. You can do it online or in person. It usually takes 2-3 weeks to hear back. Then, you’ll know if you got the card.

What is the impact of the Karobar Card Scheme on small-scale enterprises?

The scheme has helped small businesses a lot. They’ve seen more sales and revenue. It’s helped them grow and create jobs. It also makes it easier for them to get loans and other financial help.

What are the benefits of the Karobar Card Scheme for large business operations?

Big businesses also benefit a lot. They get loans at low interest, help with equipment, and tax breaks. The scheme also helps them grow by offering training and connecting them with new customers.

What is the implementation timeline and phases of the Karobar Card Scheme?

The scheme is being rolled out in stages. First, it’s for small businesses, then for big ones. Next, it will expand to more areas of Punjab and offer more funding.

What supporting infrastructure and resources are available for businesses under the Karobar Card Scheme?

The scheme offers many resources. There’s training, help finding customers, and financial support. Businesses also get help with equipment and materials, and tax breaks.

How is the Karobar Card Scheme monitored and evaluated?

The scheme is closely watched to see how well it works. It looks at how many businesses it helps and how much money it gives out. It also checks if the scheme is improving the economy and addresses any problems.

What is the economic impact of the Karobar Card Scheme on Punjab’s business landscape?

The scheme has greatly helped Punjab’s businesses. It has boosted the economy, created jobs, and made businesses more competitive. It has also made it easier for businesses to get the money they need.